Seattle Legal Services PPLC Blog

Seattle Legal Services PPLC Blog

Can I Sell My House With a Tax Lien?

Selling a home isn’t the easiest thing to do, and this process can become more complicated if your house is

FHA Loans When You Owe the IRS

Buying a home with an FHA loan is often one of the most accessible paths to homeownership, particularly for first-time

Offer in Compromise Attorney Fees: What’s Reasonable?

An offer in compromise (OIC) is one of the best ways to resolve an unpaid tax bill. However, it comes

My Employer Didn’t Withhold Enough Tax

This is a situation thousands of taxpayers find themselves in every year. Although they’re certain they filled out their tax

My Spouse Has Tax Debt. Should I File Separately?

The question of how spouses should file taxes if one of them has a history of tax debt or is

How to Switch from an IRS Payment Plan to a Better Option (OIC, CNC, PPIA)

Getting help with your tax issue is the first step toward resolution. But sometimes, you may rush into an IRS

IRS Automatic First-Time Penalty Abatement Starting in 2026

The IRS imposes penalties for filing returns late, paying taxes late, and other common tax errors. The main goal of these penalties is to encourage compliance, not punish honest mistakes that leave Americans in an even worse position. That’s why the IRS has made the decision to make first-time penalty

Gambling Tax Lawyer: When You Need One and How They Help

You won big and need to know how to pay your gambling taxes. Perhaps, you’re not sure how to report gambling income or whether you can claim deductions. Or maybe the IRS adjusted your return or selected you for an audit related to your gambling income. Regardless of the situation,

How Many Years Can the IRS Collect Back Taxes? 10-Year Rule Guide

A little research on “tax relief” or “tax forgiveness” will lead you to the Collection Statute Expiration Date (CSED). This is the time limit the IRS has to collect tax debt from you. Yes, you heard that right: after the CSED period, the IRS is no longer allowed to pursue

How Long Will the IRS Give Me to Repay Back Taxes?

Back taxes are simply money you owe the IRS. They could’ve resulted from filing and not paying, not reporting your full income, a lack of funds to cover your tax debt, an audit that led to additional tax, or several other reasons. Regardless of why you owe the IRS, not

Will Hiring a Tax Attorney Make the IRS Suspicious?

You’re sitting at your kitchen table reading the mail, and there it is: a letter with the Internal Revenue Service return address. Maybe it’s a notice of an audit, a demand for back taxes, or the heart-stopping news that a revenue officer has been assigned to your case. Your first

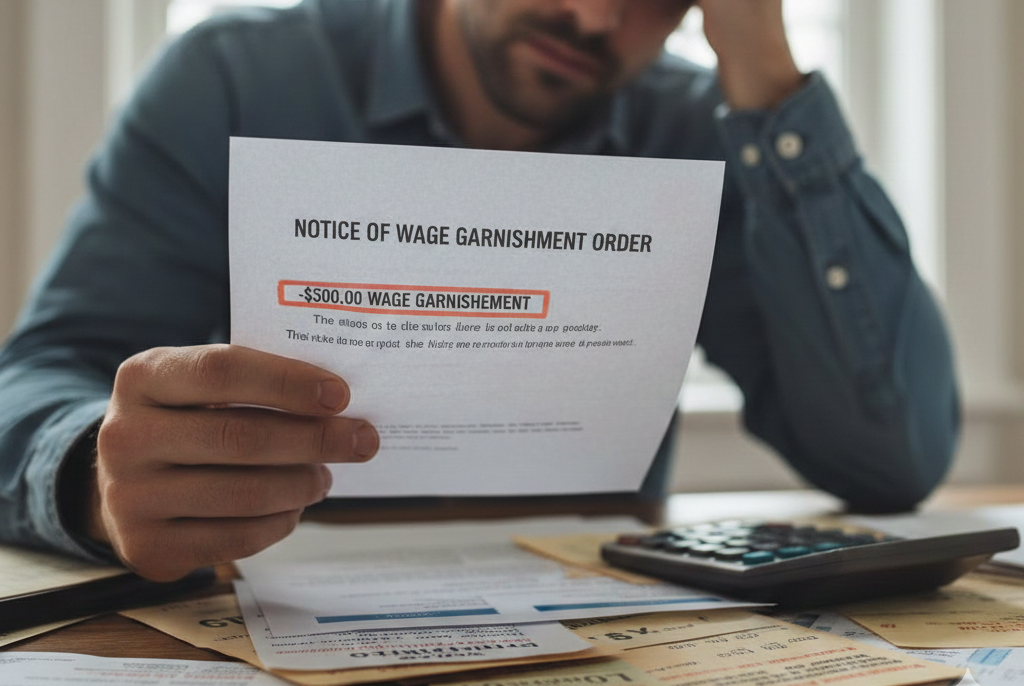

Does the IRS Have to Notify You Before Wage Garnishment?

Nothing shocks taxpayers like seeing a smaller paycheck out of the blue – and if you owe taxes to the IRS, this is a significant risk. The IRS often uses wage garnishment to collect from taxpayers who don’t pay. But wage garnishment almost never happens without a paper trail. The

Categories

- Business Taxes (11)

- Tax Audit (3)

- Tax Collections (29)

- Tax Notices (5)

- Tax Payment Plans (11)

- Tax Relief (33)

- Unfiled Taxes (3)

- Washington DOR (2)