Short On Money? Apply For an IRS Payment Plans – Seattle Legal Services

Don’t let unpaid taxes ruin your financial future – apply for an IRS payment plan today.

Are you short on money and struggling to make your IRS tax payments? If so, you may be eligible for an installment agreement with the IRS. An installment agreement is a payment plan that allows you to pay your taxes over time in monthly installments, and is based on your ability to pay/not pay. Our experienced tax attorney can help.

If you owe taxes, then you may have received a bill from the Internal Revenue Service. Fortunately, tax debt doesn’t mean you will automatically be penalized by the IRS. The IRS offers several payment plans for taxpayers to settle debt with low interest. If you owe state taxes to Washington, you also may qualify for a payment plan with the WA DOR. Learn more about these payment arrangements, how to apply, and when to contact a tax attorney.

Installment Agreement: In simple terms, it is a payment plan. What is not simple is determining the appropriate TYPE of payment plan and the most favorable monthly payment amount. Many taxpayers are unaware of the requirements and pitfalls of setting up a payment plan on their own with the IRS. You can bet a dime to a dollar that the IRS will want to set up a payment plan that is in its best interest, NOT YOURS. You can level the playing field by having me work to protect your interests and set up a payment plan that is optimal for you.

At Seattle Legal Services, we have experience representing taxpayers in all types of payment plan negotiations with the IRS, and we can help you set up a payment plan that is right for you, and that is based on YOUR ability to pay.

“When I set up payment plans for my clients, I negotiate the lowest legally allowable monthly payment amount. Our goal is to achieve the most favorable outcome for EVERY client. Do not mistake negotiating your own installment agreement without seeking professional help.” Call us now to see what you qualify for!

What Are IRS Payment Plans?

If you owe taxes to the IRS and can’t pay them in full, you may be able to set up an installment agreement. With an installment agreement, you make monthly payments toward your tax debt. The IRS will work with you to set up a payment plan that’s affordable for you, based on your income and other factors. The IRS allows you to set up payment plans on relatively small balances, but if you qualify, you can also get payments on tax debts of $20,000 or much higher.

What Are the Benefits of an IRS Payment Plan?

There are several benefits of setting up an installment agreement with the Internal Revenue Service.

- You can avoid penalties and interest. When you set up a payment plan, the IRS agrees to waive any late penalties and interest that would otherwise accrue on your tax debt.

- Your tax won’t increase. The interest and penalties that accrue on unpaid taxes can quickly add up, making your tax debt larger. An installment agreement can help you avoid that.

- You can avoid collection actions. Once you set up a payment plan, the IRS agrees to stop any collection actions it was taking against you. This includes wage garnishment, bank levies, and property liens.

What Are the Requirements for an IRS Payment Plan?

As with any process involving the IRS, certain requirements and conditions must be met in order for you to qualify for an installment agreement. Make sure you have the following information before beginning the application process:

- Name as it appears on the most recently filed tax return.

- The address you provided on your most recently filed tax return.

- Date of birth.

- A valid email address.

- Your Social Security number or Individual Tax ID Number.

- Filing status.

- Balance due amount.

- Financial account number, mobile phone registered in your name, or an activation code received by mail

Who Is Eligible for an IRS Payment Plan?

Generally, any taxpayer who owes taxes and can’t pay them in full can set up an installment agreement with the IRS. The following are the eligibility requirements for an installment agreement:

- Have submitted your tax returns on time for the preceding five years.

- Agree to pay off your tax debt within the collections statute.

- You’re unable to pay the taxes you owe in full.

- Are not currently experiencing bankruptcy.

What Are the Different Types of IRS Payment Plans?

If you are struggling to come up with the full amount for your tax debt, don’t worry–you may be able to set up a payment plan. The IRS offers two payment plans to help low-income taxpayers who are short on cash.

Short-term payment plan

If you owe the IRS and want to avoid interest or penalties, consider making a timely payment. You can ask for an extension of time (up until 180 days) without paying any fees; however, since this is not a formal repayment option, there will still be accruing interests if payments aren’t made in full – so use caution when deciding what’s best.

Long-term payment plan with Installment Agreement

If you need more time to repay what you owe, you can set up a long-term payment plan (also called an installment agreement). You’ll have more than 180 days to repay the taxes you owe, and you may have to pay a setup fee. Penalties and interest continue to accrue during the payment plan.

How to Apply for an IRS Payment Plan?

There are 3 ways to apply for an installment agreement.

Online

IRS Online Payment Agreement program gives you an easy way to get installment agreements. If qualified, follow instructions, and your answer will be given immediately, or alternatives offered if not eligible for this service.

You can use the IRS’s online payment agreement process; it’s as simple as filling out some forms and asking questions about your financial situation, so they know how much money is owed on taxes already due (or coming up soon!).

By Mail

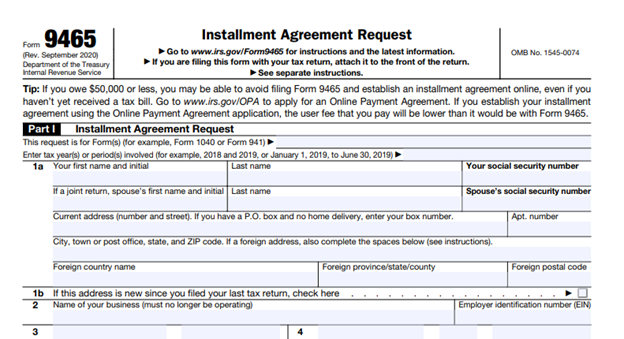

If you’re not comfortable using the online system or don’t have access to a computer, you can also print and complete Form 9465 and then mail it to the address listed on the form with all the required documents.

You must also complete a different form for a regular installment agreement:

- Form 433-F for individuals.

- Form 433-B for businesses.

By Call

If you want to set up a payment plan but have questions, you can call the IRS to speak with a customer service representative. They can help you determine eligibility and what type of plan would work best for your situation.

- If you are an individual taxpayer, call 800-829-1040.

- If you are a business taxpayer, call 800-829-4933.

Apply for an IRS payment plan today and focus on your finances.

You may also need to file form 433-D to finalize your agreement.

How to Avoid Defaulting on an IRS Payment Plan?

If you enter into an installment agreement with the IRS, it’s essential to make your payments on time and in full. If you default on your payment plan, the IRS may take enforcement actions against you, including wage garnishment, bank levies, and tax liens.

If you’re having trouble making payments, contact the IRS as soon as possible to explain your situation and make alternate arrangements. The sooner you act, the more options you may have to avoid default.

IRS Refuses Your Installment Agreement Proposal: Causes

If the IRS denies your request for an installment agreement, there may be some reasons.

Some of your living expenses are not considered necessary

The IRS believes that you have the ability to repay your debt in full, and they do not want to set up a payment plan. For instance, if you own a second home, a boat, or an expensive car, the IRS may think you have enough extra money to pay off your tax debt without a payment plan.

Your information on your Collection Information Statement, Form 433-A, is incorrect or incomplete

The IRS may suspect you are attempting to conceal assets or earnings. If your name appears on public records as the owner of property or vehicles you didn’t disclose, or if the IRS receives W-2s or 1099s with greater pay than you declared, be ready to explain.

You failed to make payments on a previous IA

If you have defaulted on an installment agreement in the past, it will be difficult to qualify for another one. You may need to offer a larger down payment or propose an alternate payment plan.

You did not provide all the information requested.

The IRS needs to know your current financial situation to determine the best payment plan for you. The IRS will not approve your payment plan if you don’t provide requested information, such as bank account statements, proof of income, or asset ownership documents.

Factors to Consider Before Requesting an IRS Payment Plan

Before you request an installment agreement with the IRS, consider the following:

- Additional Costs – The IRS imposes a user fee for anyone who wants to set up a payment plan. The fee will depend on how you make your payments and can be as little as $43 or as much as $105. Remember that even if you are on a payment plan, tax penalties, and interest will still accrue on any unpaid balance until it is all paid off.

- Affect on Credit Score – While an installment agreement with the IRS will not directly affect your credit score, tax liens placed on your property will. And, if you default on your payment plan, the IRS can take enforcement actions against you that could damage your credit, such as wage garnishment or a bank levy.

- Appropriation of Refunds – If you owe the government money, any future tax refunds will be applied to your outstanding debt. If a refund is taken, you must make monthly installments until the debt is paid in full.

What if I Can’t Afford an IRS Payment Plan?

If you can’t afford an IRS payment plan, you may be able to negotiate an extension or offer in compromise. An extension will give you more time(30 days to years) to pay your debt if you qualify for non-collectible status, while an offer in compromise will allow you to settle your debt for less than what you owe. There are also partial payment installment agreements that let you pay less than a standard payment plan every month, and at the end of the term, the IRS settles the remaining debt.

Whatever the reason for the tax debt and the solution, it is always best to seek the help of a qualified tax attorney to ensure that you are taking the best course of action for your particular situation.

Contact Seattle Tax Attorney for More Information or Assistance with an IRS Payment Plan

If you need help negotiating an IRS payment plan or any other tax resolution issue, the tax resolution team at Seattle Legal Services is here to help.

With our 11 years of experience dealing with the IRS, we can help you find the best way to deal with your tax debt and get you on a payment plan that you can afford. Contact us today for a free initial consultation.

Get help paying your taxes with a payment plan.

Frequently Asked Questions on IRS Payment Plans

Late payment penalties range from 5% to 15% of the unpaid tax, depending on the circumstances. The yearly return on investment has been adjusted for each month to 4%. When a low income taxpayer cannot obtain a loan, the IRS provides choices for repayment.

The form you’ll need to fill out to request an IRS payment plan is the Installment Agreement Request, Form 9465. You can get this form from the IRS website, a tax professional, or by calling the IRS.

Form 9465 can be submitted online or electronically to the Internal Revenue Service in any version of the tax law. Form 9265 is available for filing by mail or electronically.

The IRS might not approve of a payment plan or an installment agreement for several reasons, but one of the most frequent is when someone lies or provides inaccurate information on their application. Giving too little money as an income estimate or making similar errors can cause a denial.

No, an IRS payment plan will not directly affect your credit score.

Penalty abatement is an IRS program that eliminates any fines associated with submitting a tax return late or paying on time. This service isn’t for you if you’re consistently late with taxes or have multiple outstanding penalties.

Given that an IRS lien attaches to your income or assets, it will be hard to get a mortgage. Tax liens don’t appear on credit reports but are bound to come up during a lender’s search for any outstanding liens. To them, unpaid taxes may signify the mortgage won’t be paid on time.

Understand that criminal investigators may show up at your home or business during an IRS investigation unannounced. Nevertheless, they will never ask for any type of payment on the spot.

Yes, your money is subject to seizure by the IRS. It’s called a wage levy/garnishment. But you won’t be shocked if the IRS plans to do this. The IRS can only seize your pay if you have an outstanding tax debt and have been sent a succession of notifications demanding payment and you have chosen to ignore those notices.

The IRS generally wants to help taxpayers pay off debt and avoid unnecessary penalties that may cause difficult financial circumstances. An IRS payment plan is intended to make it easier for individuals to reduce debt through various payment arrangements, including lump sum payments and monthly payments.

An IRS payment plan is also called an IRS installment agreement. Installment agreements come in many forms so that taxpayers can pick the plan that is most appropriate for their current financial situation. The most common IRS-approved plans include:

Short-Term Payment Plan

A short-term payment plan is the first option offered to most taxpayers. If the IRS determines that you have tax debt, you will usually have up to 180 days to pay any debt you owe in full. To qualify for a short-term installment agreement, you must owe less than $100,000 in combined tax, interest, and penalties.

It’s important to note that any interest on your tax debt will continue to accrue until you have paid your debt. If you are unable to pay your taxes within 180 days, you will need to apply for another IRS payment plan.

Direct Debit Installment Agreement

A direct debit installment agreement is an IRS payment plan that is ideal for most taxpayers. With this plan, electronic debit payments will be made each month until your debt is paid off. The automatic monthly payments are usually taken from your checking account, although some taxpayers may prefer to make payments from their savings account.

You will need to fill out specific forms with written authorization to initiate automated payments to the IRS. Some taxpayers may need to work with their bank or credit union to establish automatic payments.

Guaranteed Installment Agreement

Another common IRS payment plan is a guaranteed installment agreement. This installment agreement is designed for individuals who owe $10,000 or less. This payment arrangement is a very easy way to pay taxes, particularly if you have filed previous tax returns on time and you have not had any previous IRS payment plans.

Partial Payment Installment Agreement

A partial pay installment agreement is a long-term payment plan that is ideal for taxpayers who will be unable to pay the total amount of tax debt within the designated time frame. With a partial payment agreement, a monthly payment will be made each month until the collection statute expiration date.

This expiration date is typically 10 years from the date the payment plan was initiated. If there is any remaining balance on your tax debt by the collection statute expiration date, the IRS will forgive the debt. The partial payment installment agreement can protect taxpayers from additional collection actions and penalties, such as liens and wage garnishment.

Streamlined Installment Agreement

The streamlined installment agreement is specifically designed for taxpayers who owe 50,000 or less in back taxes. Like the direct debit payment arrangement, taxpayers will not have to provide specific financial information to apply or qualify for this plan. The IRS will give taxpayers under this plan six years to pay the tax bill in full.

For most IRS payment plans, the minimum monthly payment for a tax bill can be deducted directly from a bank or savings account. Making payments on time is easier when you sign up for an online IRS account or create a payroll arrangement with your employer to generate automatic withdrawals from your wages.

Taxpayers may prefer to pay monthly tax bills via money order if direct pay options are not a good fit for their financial situation. You can send payments to your local IRS office if you are paying by check or money order.

Your monthly payment amount will be determined by the federal tax you owe and your wages. Your payment amount may also be influenced by the term of your payment arrangement.

For instance, long-term payment arrangements may have a smaller minimum payment. Taxpayers who owe significant tax debt may have a higher monthly payment.

To apply for an IRS payment plan, you will need to have information such as your individual tax ID number, your tax return for the most recent tax year, your financial account number, and other personal identification information.

For some plans, there may also be a setup fee or a user fee. The setup fee can range from $130 to $225, depending on the way you apply for your payment plan. For low-income earners who cannot afford to pay the setup fee, the user fee may be waived if you agree to a direct debit arrangement, or the user fee can be reimbursed when your debt is paid in full.

Online Payment Agreement Application

Applying for your payment plan online is generally the most convenient way to make an IRS payment arrangement. With the online application, you will need to register an IRS account and verify your account with the mobile phone registered in your name. An online account can be used to manage all of your payments, including a short-term payment plan.

The cost of application fees is determined by how you apply for your payment plan, with online applications costing less than phone or mail applications. Sometimes, application fees may also be determined by your income bracket.

Except for some installment agreements, you will always need to provide financial information to apply for an IRS payment plan. This information can include your bank account, 401k, IRA, and other savings accounts. If you have multiple bank accounts, you will also need to disclose those accounts on your application.

It’s possible for a low-income taxpayer to owe a tax debt to the federal government. Low-income taxpayers may benefit from special rules, such as setup fee waivers. To determine if you qualify as a low-income taxpayer, your adjusted gross income must be at or below 250% of the federal poverty level. The applicable federal poverty level is determined by the current tax year.

The IRS approves applications for installment payment plans within about 30 days when you apply online, over the phone, or by mail. Sometimes, approval for your payment method may take longer during filing season, which is usually from January to April each year.

If you have tax debt, it’s generally in your best interest to apply for an installment agreement. An installment agreement is the best way to reduce your tax bill while also avoiding major financial complications, such as actions the IRS may take against you for failing to pay taxes.

Avoid Tax Lien

Applying for an IRS installment agreement is the best way to avoid a federal tax lien on your personal property or business property. When the IRS files a tax lien on your property, it means that the IRS has the right to seize the property if you fail to pay off your tax debt.

Avoid Penalties and Interest

Applying for an installment agreement is also a good way to avoid any applicable penalties and interest on your tax debt. The IRS charges up to 0.5% in interest on taxes you owe as part of a failure-to-pay penalty, and your debt may be subject to other penalties, as well.

Although the interest rate for individual taxpayers is adjusted quarterly, high interest on a tax bill can still add up quickly and make it more difficult to pay off your debt. This is particularly true if you owe between $50,000 and $100,000 in back taxes and you are applying for a long-term payment plan.

Avoid Bankruptcy

Meeting the minimum monthly for your back taxes is also a good way to avoid bankruptcy. Taxpayers who are unable to pay off their taxes or who want to remove liens on a property may file for bankruptcy, but this is an extreme step that may not fully relieve the burden of tax debt.

If you fall behind on payments, the IRS may charge you a reinstatement fee when you resume your installment agreement. Like a setup fee, the IRS may waive or reduce the fee to reinstate your payment plan if you can’t afford to pay the fee.

Some taxpayers may turn to a tax relief company for help in applying for an installment agreement. However, the Federal Trade Commission has issued warnings to taxpayers that these companies may not offer IRS-approved payment plans. It’s important to work with a tax attorney so you can avoid unwanted penalties and interest on your tax debt.

Can a Tax Attorney Help?

For taxpayers who default on their payment arrangement or who are unable to pay off tax debt without filing for bankruptcy, it may be necessary to contact a tax attorney. An attorney can help you apply for settlements with the IRS, such as an offer in compromise.

If you are worried about your ability to pay your taxes, you may want to consider applying for an IRS payment plan. Monthly payment plans will generally include the sum of your combined tax debt, penalties, and interest and can be paid with automatic withdrawals from your bank or payroll account. Contact Seattle Legal Services, PLLC at 206-895-7268 to learn more about which IRS payment plan is most appropriate for you.