IRS Penalty Removal – Get Rid of Those Pesky Fees Today!

Stop wasting your hard-earned money on fees and penalties

Getting a penalty letter or notice from the IRS has never been a good feeling. But what’s even worse is finding out that you owe them money in penalties and fees. In this situation, you’re probably wondering how to get rid of those pesky fees.

The good news is that getting rid of IRS penalties is possible. The process is called penalty abatement. Our experienced tax lawyer has extensive experience in drafting and negotiating successful penalty abatements. I can help you get the IRS to reduce or waive your penalties and put more money back in your pocket if you qualify.

There are two main types of Penalty abatements:

- First-Time Penalty Abatements

- Abatements for Reasonable Cause.

In either case, I will only recommend pursuing a penalty abatement if I feel a taxpayer is a strong candidate for this resolution. During Phase 1 of every case, I perform a detailed IRS Transcript Analysis to determine if my client meets the legal criteria for penalty abatement.

Reasonable Cause & Not Willful Neglect Abatement requests are granted if a taxpayer can argue/show that they acted with reasonable cause and not willful neglect in accruing the tax liability that gave rise to the penalties. A First Time Penalty Abatement will be granted for the oldest tax balance owed if the three years prior do not have any penalties.

Be cautious of tax relief companies that guarantee they will get your penalties removed. These companies often use high-pressure sales tactics and end up charging you a lot of money for their services without actually getting your penalties removed.

I have a proven process for penalty abatement that has helped many of my clients get rid of their penalties and save money. I will work with you to gather the necessary documentation and information and draft a compelling argument for why the IRS should grant your request for penalty abatement.

If you’re ready to start your penalty abatement, I urge you to contact me today. I’ll be happy to answer any questions you have and get started on your case.

Let us help you take the burden of taxes off your shoulders

What is IRS Penalty Abatement?

When the IRS removes any penalties that have been assessed against you, it’s called a penalty abatement. While there are many reasons for receiving one of these reliefs in tax season – including failure to pay or late filing- the most common is accuracy-related imperfections on your behalf. Taxpayers who receive this kind of gift from their government still owe every penny they neglected to pay before being granted the penalty abatement.

The IRS is not a forgiving organization. They dole out abatements sparingly and only when they feel that the circumstances of your case meet their criteria for granting relief – which can be tough to satisfy in some cases. Most importantly, you must request penalty abatement by contacting them directly with proper documentation as proof-of-pain score verifications.

Interest in penalties is not just annoying; it’s also expensive. And the IRS knows this because they charge interest whenever a penalty becomes due.

The good news is that if the IRS grants you a penalty abatement, they will waive the interest accrued on that penalty. This is a fantastic way to save money and get out of a bind with the IRS.

How Can Penalty Removal Help You Get Back on Track Financially?

Having the IRS erase penalties from your account gives you a chance to start over. Following are some ways in which this can help you get back on track financially:

- You’ll save money on interest.

- You can focus on paying down your tax debt instead of worrying about penalties.

- You can avoid further legal action from the IRS.

- You can improve your credit score.

- You can get peace of mind knowing that your tax debt is manageable.

If you’re struggling with tax penalties, contact me today and avail benefits mentioned above with IRS penalty abatement.

What Are the Methods of IRS Penalty Removal?

If you’re looking for ways to get rid of IRS penalties, there are three methods you can try:

First-time Penalty Abatement and Administrative Waiver

The first legal method is to request a first-time penalty abatement or an administrative waiver from the IRS. But it is only available to those who have never been penalized before or who can show that they had a reasonable cause for not paying their taxes on time, such as; failing to pay, failure to file, or failure to deposit taxes. This method is not available to those penalized for fraud or willful evasion.

Reasonable Cause Penalty Abatement

Being unable to pay your taxes on time does not necessarily mean that you will qualify for penalty abatement. The IRS will only grant relief if you can show that you had a reasonable cause for not paying your taxes on time.

The IRS will want a justifiable cause prior to agreeing on your abatement of tax penalties.

Some examples of reasonable cause include:

- Serious illness, unavoidable absence, or death

- Natural disaster, flood, fire, or casualty

- Unable to retrieve records

- Mistakes (It is tough to obtain penalty abatement simply through mistakes.)

- Undue Hardship

The IRS will want a reasonable explanation before agreeing to lower your tax penalties. When you appeal a estimated tax penalty, the IRS handbook has numerous reasons that may be utilized. It is feasible to win your case with a reason not mentioned in the book, but it will most certainly be more difficult.

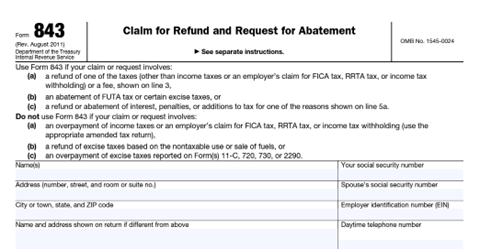

Form 843 for Abatements

The IRS allows for an abatement of interest or penalties if you made mistakes when filing your taxes. You can ask them to reduce this using Form 843, which must be filed within two years following the tax payment date and almost three more after it’s been reported on a return.

You must complete Form 843 for each incorrectly assessed tax each year. The relief form may be used to ask the IRS to issue you a tax refund that it has mistakenly calculated.

If the IRS agrees with your penalty abatement request, they will issue you a refund for any paid interest or penalties.

The IRS Form 843 may be used to alleviate a variety of problems, including the following:

- Mistakes or delays caused by the IRS.

- Estate or gift taxes that have been incorrectly calculated.

- Social Security and Medicare taxes were wrongly taken from my paycheck.

Who Is Eligible for IRS Penalty Removal?

If you attempted to comply with tax rules but could not do so due to reasons beyond your control, you may be eligible for a penalty reduction.

Double-check the details if you received any notice from the IRS informing you that a penalty will or has been applied to your account. If the information isn’t correct, follow the steps outlined in your letter. A penalty may not be necessary if you can resolve the problem. See Understanding Your Notice or Letter for more details on penalties and interest.

The IRS considers the following situations before reducing or removing penalties:

- Information Return

- Accuracy-Related

- Dishonored Check

- Failure to Pay

- Failure to File

- Underpayment of Estimated Tax by Individuals

- Failure to Deposit

- Underpayment of Estimated Tax by Corporations

How Can I Get Started with Penalty Removal if I’m Interested in IRS Penalty Removal Service?

If you’re interested in the IRS penalty removal service, the first step is to find a reputable tax law firm that can offer you a free consultation. From there, you’ll need to provide the tax law firm with all the necessary documentation, including any notices you’ve received from the IRS.

Once the tax law firm has reviewed your case, they’ll be able to give you a better idea of what options are available to you and how likely it is that you’ll be able to get the penalties removed.

At Seattle Legal Services PLLC, I offer free consultations for IRS penalty removal cases. I am very proud of the results that I get for my clients.

Fighting the IRS is one of the most rewarding things I have ever done.

Here’s What I Achieved for One of My Clients Who Faced the Same Situation as You

Below I have uploaded a Redacted IRS Notice one of my clients received after I successfully abated $54,218.27 for them. This particular abatement was for Reasonable Cause and Not Willful Neglect.

I have a proven track record of successfully securing penalty removal for my clients. If you have concerns or questions regarding IRS penalties, or if you’re unsure about your eligibility for penalty relief, don’t hesitate to reach out.

I’m here to provide you with a thorough consultation and guide you through the process. Whether you need assistance with penalty negotiations or simply want to explore your options, I’m ready to assist you.

For a detailed consultation and expert guidance on IRS penalty relief, please get in touch with me at 206-536-3152. Don’t let IRS penalties weigh you down any longer – take action today, and let’s work towards resolving your tax issues together. At Seattle Legal Services, PLLC, your financial peace of mind is my priority.

Don’t let those fees keep you down – remove them today!

Frequently Asked Questions

What is reasonable cause relief for IRS penalty abatement?

When the IRS discovers that a taxpayer has failed to file, make a payment, or pay taxes when due, it will consider any legitimate excuse. Fire, severe weather, natural disaster, or other calamities are all acceptable reasons for the IRS to excuse a taxpayer. The death of a spouse or close family member is another example of a reasonable cause to request relief provisions.

Can you negotiate with the IRS?

When you can’t pay your full tax debt, an offer in compromise lets you settle for less than the amount you owe. It may be a viable option if you can’t afford to pay penalty on your entire tax bill or if paying it would create a financial hardship.

How long does it take form 843 to process?

The processing time for Form 843 can vary depending on the issue being resolved and the current workload of the IRS. It can take anywhere from 12 weeks to 4 months.

Can you file form 843 online?

No, Form 843 must be filed by mail.

What happens if you don’t file for 3 years?

If you don’t file for 3 years, you’ll lose your right to a refund for that tax year. It’s likely that the IRS has taken your tax return. Your employer will send you a W-2 or 1099, which the IRS can access.