Federal Tax Liens – Seattle Legal Services

Don’t wait to get help. A qualified tax lien attorney can make a big difference.

The Internal Revenue Service (IRS) may place a “federal tax lien” on your property if you have unpaid federal taxes. This lien is a legal claim against your property that gives the IRS a priority interest in your assets.

A Notice of Federal Tax Lien is filed in the county recorder’s office where a taxpayer lives. The two main reasons the IRS uses this collection enforcement tool are as follows:

- A Notice of Federal Tax Lien protects the government’s interest by publicly notifying creditors that the IRS has priority in collecting its debt.

- To encourage taxpayers to come to the table and resolve his/her tax liability. Once a taxpayer has a Federal Tax Lien filing, their credit score may be affected by 50-100 points.

This negative impact on credit increases the cost of borrowing and can prevent the ability to borrow/enter into contracts like leases, etc.

Do not ignore a Notice of Federal Tax Lien; it is a serious matter, especially if a local Revenue Officer signs it. Once a Federal Tax Lien is filed, a taxpayer is given 30 days to file a Collection Due Process Hearing Request to Appeal the lien filing. These Appeal rights can be very important to a case’s resolution/final outcome.

If you have received certified mail from the IRS that contained a Notice of Federal Tax Lien, call our tax attorney in Seattle immediately to Preserve Your Rights and Protect You From The IRS!

What Are Federal Tax Liens?

There are many tax issues that may occur when you fall behind on tax payments for either federal or state taxes. A tax lien is a legal claim the IRS can make on your personal property, such as your home or your business assets.

Essentially, an IRS lien is used to incentivize taxpayers to pay off tax debt, since when a lien is active and unpaid, the government has the right to seize property. Once the back taxes are paid in full, the lien will be removed. An experienced tax lein attorney in Seattle can help.

Federal Tax Liens vs State Tax Liens

An IRS tax lien is most common in cases where you have not paid all federal taxes to the federal government. State tax liens, on the other hand, are taxes that are owed to your state. In some states, taxpayers may not need to file state taxes unless they fall under a certain income bracket.

Washington State does not support a state tax lien; instead, Washington State supports a tax deed, which can force tax foreclosure actions on properties with unpaid taxes. If you are a taxpayer in Washington and you have received a notice for a tax lien, then you most likely need to address a federal tax lien.

How Are You Notified About IRS Liens?

The IRS will always notify delinquent taxpayers when a tax warrant has been filed by the federal or state government. You will receive a notice about any tax liens on your property via certified mail. Once you receive your notice from the IRS, it’s in your best interest to contact a Seattle tax lien attorney as soon as possible.

What does an IRS lien signify?

If you owe back taxes and the IRS issues a federal tax lien against you, what follows is what might happen.

Your creditworthiness could drop significantly

Although tax liens may no longer appear on credit reports, the IRS can still issue a public notice of the tax lien, informing creditors that the federal government has a claim to your property. That could jeopardize your chances of obtaining financing in the future.

It might jeopardize the closing of a house sale or refinancing

If you try to sell your home or refinance your mortgage, the tax lien will have to be paid off first before the transaction can be completed.

Wasting time can end up costing you a lot

If you want the IRS to release the tax lien before you pay your debt in full, you will have to take specific steps and pay a fee. The process can be difficult and time-consuming, and there’s no guarantee the IRS will agree to remove the lien.

You may be subject to a tax levy

If you don’t pay your taxes or reach an agreement with the IRS on a payment plan, the next step the IRS might take is to levy or seize your assets. The IRS could take money from your paycheck, freeze your bank account, or seize and sell your property.

How Do Federal Tax Liens Work?

When the IRS determines that a taxpayer owes money, they send the person a bill detailing how much is owed. This notice is called “notice and demand for payment.” If the debtor does not pay their obligation on time – whether due to negligence or choice – the IRS can legally place a lien against personal assets.

A lien covers a taxpayer’s assets, including equities, real estate properties, and automobiles. The lien can also be used to seize any property the individual purchases when it is in force. The lien covers a business’s accounts receivable, rights to business property, and commercial property. If a taxpayer files for bankruptcy, the lien, and tax debt often continue even after bankruptcy. This is notable because bankruptcy usually wipes out a person’s debt.

Tax liens are distinct from tax levies in that they simply indicate the government’s right to seize property rather than the actual seizure of it. The IRS will frequently “perfect” a tax lien by notifying other states and creditors that it is first in line to receive payment for the back taxes. A federal tax lien tends to reduce an individual’s credit score significantly. In many cases, individuals with a tax lien must pay their debts in full before regaining access to any financial assistance.

How to Prevent From Getting an IRS Lien?

The best way to prevent getting a tax lien is to avoid falling behind on your taxes in the first place. That means filing and paying your taxes on time, every time.

If you find yourself in a situation where you can’t pay your taxes in full, don’t ignore the problem. The sooner you contact the IRS, the better your chances of negotiating a payment plan that works for you and the IRS.

If you can’t pay your taxes immediately, the IRS may be willing to work with you. They offer various payment options, such as an installment plan, to help you catch up on your taxes without incurring a tax lien.

Keep in mind that IRS would never file a tax lien without sending a bill first. So, if you receive a notice from the IRS that you owe taxes and you don’t pay, they will take action.

Set up a guaranteed or streamlined installment agreement with the IRS, and it will not file a federal tax lien. The taxpayer is responsible for contacting the IRS to establish these arrangements. The IRS won’t force taxpayers to utilize these alternatives to avoid lien filing.

The lien process is complicated, and the rules vary depending on the type of tax and your circumstances. So, if you’re facing a tax lien, it’s best to seek the help of a tax lien lawyer who can help you navigate the process and negotiate with the IRS on your behalf.

Contact a Seattle tax attorney to discuss your federal tax lien and options.

How Can a Tax Lien Lawyer Help Get Rid of a Federal Tax Lien?

Pay your tax bill before they become due

The easiest way to get rid of a federal tax lien is to pay your taxes in full before they become due simply. It might sound very difficult, but you can make it possible by adjusting your withholdings or making estimated payments throughout the year. This will help you avoid any penalties or interest, and you won’t have to worry about the IRS putting a lien on your property.

Get on an IRS payment plan.

You can apply for an IRS payment plan if you can’t pay your taxes in full. This will allow you to make monthly payments to the IRS until your balance is paid in full. The payment plan will also help you avoid any penalties or interest.

You can choose between a guaranteed or streamlined installment agreement if you qualify for a payment plan.

Ask for an Offer In Compromise

This tempting settlement offer for back taxes falls short of the full amount you owe. Keep in mind that there are many restrictions, and the IRS typically accepts less than half of all proposals it receives each year, but you can appeal OIC rejections. To be considered, you must have previously filed all of your tax returns and made the required estimated tax payments for the current year. You won’t be considered if you’re going through bankruptcy or being audited.

File an appeal

If you want to lodge a complaint about a lien or levy notice, you can request a collection due process hearing from the IRS Office of Appeals. Additionally, if you take issue with an employee’s decision surrounding a lien or levy, you can ask for a said conference with their manager and review your case through the Office of Appeals.

Bankruptcy

If you’re struggling with a tax lien and can’t seem to find a way out, you might want to consider filing for bankruptcy. This will relieve your tax debt and allow you to get on a payment plan.

Removing a Federal Tax Lien from the IRS

If the IRS determines that a federal lien was filed initially in error—such as when the wrong taxpayer is targeted for a debt—it will reverse (or “withdraw”) it. It’s as if the lien never existed in the first place in that situation.

If you think this might be your case and a lien was mistakenly filed against you, reach out to the IRS as soon as possible. After reviewing your account history that no taxes are owed, an agent will begin preparing the paperwork needed for the withdrawal of the false claim.

You or your tax professional can also request the withdrawal of a federal tax lien.

Tax Lien Subordination

You can request tax lien subordination when you need to take out a new loan, apply for a second mortgage, or refinance your home or other assets. Lien subordination allows another creditor’s lien to take on a higher priority than the IRS’s lien. That allows you to take out loans to pay off your tax debt. Tax lien subordination doesn’t remove a lien but can give you more flexibility in getting your debt paid off.

Releasing IRS Liens

If the IRS agrees to a request for a “discharge” of property from your federal tax lien, the specific property is no longer subject to the lien. After the tax obligation has been paid in full, or if you establish a certain or simplified installment agreement, liens are released within 30 days.

Effects of Having a Federal Tax Lien

Federal Tax Lien Impacts Your Credit

Even though a tax lien does not appear on your credit report, the IRS publishes this information for everyone. Organizations such as lenders, landlords, and employers could learn about outstanding liens against your property. They may use that information to assess you—for example, whether or not to give you a loan, offer you a lease, or extend an employment opportunity.

A Lien Can Affect You Getting A Job

In extremely rare cases, a lien might affect your ability to keep or get a job. Just remember that liens will be visible not only to creditors but also on your credit report. So, if the company you’re applying to runs a credit check as part of its hiring process, you may have some difficulties. If this is ever the case, don’t hesitate to reach out to the IRS and request that they release the lien.

The IRS would be willing to give up the lien if you can show that all other factors are equal and each case is looked at on its own. You’ll have a better shot at getting the position now that you’ve released the lien. The IRS would accept this settlement because you will now earn an income.

How Can a Tax Lien Attorney at Seattle Legal Services help resolve your tax debt problems?

The IRS is a powerful organization, and they have many tools at its disposal to collect unpaid taxes. One of those tools is the federal tax lien.

A federal tax lien gives the IRS a legal claim to your property—including your home, car, bank accounts, and wages—until your tax debt is paid in full.

If you have a federal tax lien filed against you, it’s important to take action as soon as possible. The longer you wait, the more difficult it will be to resolve the issue.

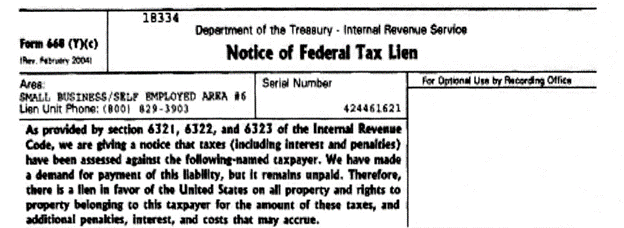

The Notice of Federal Tax Lien is filed on IRS Form 668 (Y)(c) and is sent to taxpayers via certified mail. The key mistake taxpayers make is not picking up certified mail from the IRS, thinking that somehow the problem will disappear by itself.

If you have received certified mail from the IRS that contained a Notice of Federal Tax Lien, Call us Immediately to preserve your rights and protect you from the IRS.

At Seattle Legal Services,PLLC, our tax lien lawyers understand the stress and anxiety that comes with dealing with the IRS. We’re here to help you resolve your tax debt problems and get your life back on track.

Call us today at 206-536-3152 to schedule a free consultation. We’re here to help you resolve your tax debt problems.

Frequently Asked Questions on Federal Tax Liens

A federal tax lien is a legal action taken by the government against your home for failing to pay taxes owed. A lien gives you the right to control any property you own, which includes property, personal property, and financial assets.

The federal tax liens expire at the end of each year after you pay taxes on your property and income tax debts for up to five years after your return. The IRS will seek your debts for a limited period, and your debts will continue to accrue after the statutory limit. This includes 10 years from the date of tax assessment

A Notice of Federal Tax Liens will alert creditors that IRS claims are secured against a person who has assets that are not yours. Credit reports look for the credit report’s notice of federal tax obligations.

The IRS will file a Notice of Federal Tax Lien in the county where you live or have assets. The lien is against all your property and rights to property, which gives the IRS a legal claim to your assets. The lien will show up on your credit report, making it difficult to get loans.

Tax liens are filed by the IRS to protect their interest(s). A federal tax lien could affect your ability to obtain credit.

Typically, a government entity has a 10-year period to pay tax liability for the tax owed. There may be circumstances that could prolong or suspend the 10-month collection period.

The government files a federal tax lien upon request by IRS. Interested in receiving an IRS tax lien? Information: 800 877-2910. Search the county recorders office in the corresponding county.

A federal tax lien occurs when the IRS assesses tax against you and sends you bills you have ignored. A government document is filed to remind creditors the government has a right on your personal property to which you are entitled.

State and local governments are in charge of property taxes, so look there first for federal tax liens. Because your county may keep real estate sale and transfer records for your region, you should be able to find the information you need on its website.

Withdrawing a tax lien is based on an IRS judgment, so you can’t simply notify county authorities that the debt has been paid. If the IRS decides in your favor, you will be notified of their ruling, and soon after, the tax lien should be withdrawn.

A tax lien is a serious issue. Although a lien does not automatically mean you will lose your property or assets, a lien that is not handled correctly could result in forced seizure and other tax problems. The most common consequences of a federal tax lien include:

Damaged Credit

While a tax lien is not included on your credit report, a public notice from the IRS about a tax lien could potentially damage your creditworthiness. When there is a lien on your public record, creditors may be less likely to approve applications for loans, which can then hinder your ability to buy a home or a car.

Delayed Personal Property Sale

A federal tax lien can also interfere with your ability to sell your property. If you are in the process of refinancing your mortgage, selling your home, or selling your business, a lien on the property can prevent you from finalizing the sale. When there is an IRS tax lien on your property, you will not be able to sell the property until all tax debt is paid.

Tax Levy and Garnishment

If you are unable to pay off your debt, then your federal tax lien could turn into a levy. A tax levy will allow the government to seize your property, such as real estate, vehicles, and business assets. In certain situations, the IRS may garnish a significant portion of your wages as part of tax levy penalties.

Although IRS liens can have a huge impact on your financial future, there are two ways you can prevent a lien in the future. Filing your taxes on time and paying your taxes in full for each tax year is the best way to avoid lien claims entirely.

You can also arrange for an IRS repayment plan, such as an installment agreement. If you are unable to pay your taxes, installment agreements can allow you to gradually pay taxes off within a certain timeframe. Having a repayment plan with the IRS will usually prevent a federal tax lien.

One of the major ways a tax lien attorney can help with your IRS debt is to assist in your application for an IRS payment plan. Selecting the right repayment plan is crucial for your financial stability, but applications for these plans can be complicated. An attorney can help you apply for the repayment plan that is most appropriate for your circumstances.

However, aside from an IRS payment plan, there may be other options for you to reduce your tax debt or remove liens. A tax lien attorney can offer crucial insight into the tax lien process and give you more information about the tax law that can help your specific situation. Some of your best options include:

Offer In Compromise

A tax lien attorney may advise you to apply for a settlement with the IRS called an offer in compromise. This option is designed to allow taxpayers to pay off back taxes for less than the total debt owed and may be a good option if you want to resolve a federal tax lien quickly.

However, there are several eligibility restrictions for an offer in compromise settlement. Taxpayers are only eligible for this option if they have filed all relevant tax returns and if they have made all tax payments for the current tax year. A taxpayer who has filed for bankruptcy will not be eligible for this repayment plan.

Collection Due Process

Instead of a repayment plan, some taxpayers may be eligible for a collection due process hearing. In this scenario, a tax lien lawyer can help taxpayers who have a complaint about a lien notice, which will then start the process of appealing with the IRS Office of Appeals. A collection due process may be necessary if a taxpayer believes a lien has been filed against them in error.

Bankruptcy

The final option for taxpayers who are unable to arrange a payment plan or settle with the IRS may be to file for bankruptcy. Bankruptcy is a legal process that can provide relief from a debt owed to creditors. For a tax lien, the bankruptcy process will help taxpayers get on a repayment plan.

A tax lien lawyer may recommend this option if the taxpayer is unable to pay tax debt without impairing their ability to pay for daily necessities. Tax lien attorneys can help with all the paperwork associated with filing for bankruptcy. A tax lien lawyer may also be able to help you with judgment liens and other legal issues.

When you start the process of working with tax lien attorneys, there may be immediate actions taken by the Internal Revenue Service depending on your repayment strategy. When you can pay off your debt in full or you apply for a repayment plan, the IRS may issue a lien withdrawal. A withdrawal will remove the public notice of your tax lien so you can avoid consequences on your credit, but you will still need to pay off your debt.

A lien discharge, on the other hand, will remove a lien from a specific property, such as your home. With a discharge, the lien will still be applied to other properties until money owed to the government is paid off or settled.

What Is Lien Subordination?

Subordination is a special arrangement that occurs when multiple creditors have a claim on your property. In general, the government always takes priority for liens; however, in some circumstances, the Internal Revenue Service may allow another creditor to have a priority claim for repayment.

Whether you want to arrange an installment agreement, remove a lien from your property, or request an appeal from the Internal Revenue Service, tax lien attorneys can keep you informed of all your options under federal and state law. Speak with a knowledgeable tax lien lawyer at Seattle Legal Services, PLLC 206-895-7268 today.