Get Help with Your Payroll Tax Problems from a Professional IRS Lawyer

Let our experienced professionals help you get back on track with your payroll taxes.

If you’re like most employers who fall behind with their payroll deposits, the thought of dealing with payroll taxes probably makes your palms sweat. After all, it’s not just about calculating and paying the taxes; there are also forms to be filed and deadlines to be met. And if you make even a small mistake, you can face stiff penalties from the IRS.

There are many reasons for this, equipment failure/unforeseen circumstances, bad receivables, the timing of cash flows, and a general decrease in sales.

Fortunately, help is available. A qualified small business tax lawyer in Seattle can take care of all the details for you, ensuring that your taxes are filed on time and that you comply with all IRS (Internal Revenue Service) regulations.

So why not let a professional handle this important task?

At Seattle Legal Services, our experienced Seattle tax attorneys can help you with all aspects of payroll tax compliance and back tax resolution.

Give us a call today to find out how we can help you!

Seattle Payroll Tax Attorney for Back Tax Resolution

Payroll tax attorneys in Seattle specialize in payroll taxes, a category of employment taxes that include things like the federal Medicare tax and Social Security tax. Likewise, federal and state income taxes are also a part of payroll taxes. These taxes are responsible for the most common tax violations since they directly affect an employee’s paycheck, and employees are quick to report employment tax disputes. Avoid payroll tax problems by working with experienced tax attorneys who you can trust.

Business Owners Ask: 3 Common Payroll Tax Questions

Does the IRS offer tax debt settlements?

The IRS is more flexible than many business owners realize. You can negotiate a settlement with the IRS to repay tax debt over time. However, penalties may apply depending on how the debt was accrued. Failing to file taxes or report your tax debt accurately can lead to serious penalties. If you file on time but haven’t paid, you can expect an installment agreement to include interest and some additional fees.

What is a trust fund recovery penalty?

If you don’t pay payroll taxes to the IRS, you can be assessed the trust fund recovery penalty, or TFRP. The amount of the penalty is equal to the amount you owe the IRS, essentially doubling your debt. The name may seem odd; however, the trust fund portion of the name comes from the fact that you are technically holding your employees’ money “in trust” as that money is owed to the IRS.

Can the IRS seize business assets over payroll tax matters?

It is possible for the IRS to seize your assets if you do not pay taxes on time. However, first the IRS will issue written notices about your tax debt. If you do not respond to these notices within a set period of time, the IRS could then proceed to seize business assets. Payroll tax lawyers in Seattle, Washington are your best defense against an IRS revenue officer.

What Is Payroll Tax?

Payroll tax is a type of tax that is imposed on employers to fund various social welfare programs. These taxes are typically deducted from an employee’s paycheck, and the employer is responsible for remitting them to the appropriate government agency.

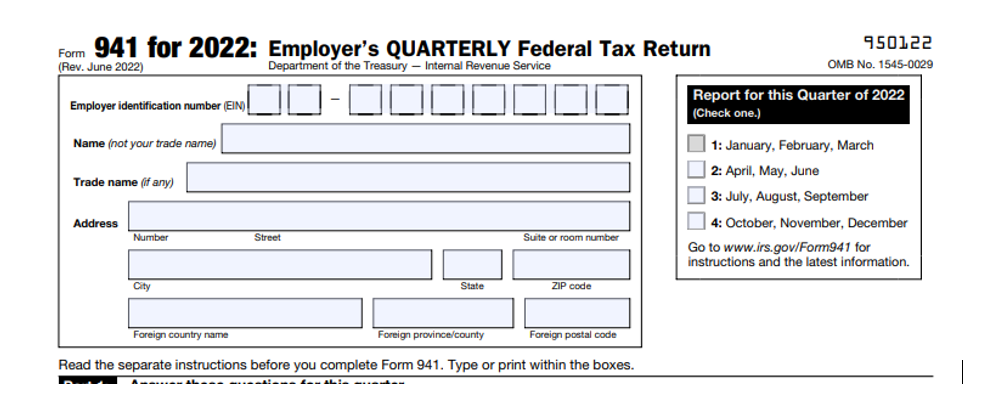

The above definition of the payroll tax is quite general, but we are here to solve your problem in accordance with the IRS. According to IRS Form 941, payroll taxes refer to the Social Security and Medicare contributions taken out of an employee’s paycheck. This is a form that employers use to file quarterly returns reporting their payroll taxes.

Most Common Payroll Tax Problems People Face

Late Payroll Tax Deposits and Payments

If you fail to make your payroll tax payments and deposits on time, the IRS will impose fines and penalties on you. There is a failure to deposit penalty of 2%, but then, depending on the length and severity of the delinquency, you may face additional penalties including the TFRP. As a result, to avoid hefty fines and penalties, make sure that your monthly taxes are sent on or before the 15th day of the month after taxes have been withheld from employee paychecks.

Failure to Withhold and Pay Federal Taxes

In the United States, all business employers must legally withhold three taxes from employee wages or salaries: federal income tax, Social Security, and Medicare taxes. If an employer does not comply, the IRS will demand that the business owner pay these withheld taxes plus additional fines and penalties. If you do not pay your federal taxes to the IRS and then are not current, you may be charged with a crime and face jail time.

Failure to Issue IRS Form 1099

Another typical issue for firms that hire outside companies or subcontractors to work for their business is failing to issue the IRS with an IRS Form 1099. You must give an IRS Form 1099 to a third party if you pay them $600 or more in any calendar year. A penalty of $75 for each 1099 not issued takes place if you do not submit the IRS Form promptly, and you may be fined up to 31% of any payment made in federal taxes.

Reclassifying Employees as Independent Contractors

You may be tempted to classify some of your employees as independent contractors to save on payroll taxes. However, this is a risky move that can come back to bite you. The IRS has strict rules about who can be classified as an independent contractor, and if you misclassify an employee, you may be required to pay that worker’s back payroll taxes plus interest and penalties.

If you are facing any payroll tax problems and need back tax resolution, it is advisable to seek the help of a qualified IRS tax lawyer in Seattle.

What Are the Penalties for Not Filing or Paying Payroll Taxes on Time?

If your business has unpaid payroll taxes or doesn’t file it on time, it accrues a failure-to-file penalty of five percent each month until the max late fee of 25 percent is reached. Even if you ignore the IRS’s written notifications and delinquency statements, it will figure out a way to get its money.

Here are some of the ways the IRS will try to collect from your business:

- Garnish wages

- A lien attached to your real property

- Levy bank accounts

- A lien attached to your business equipment

If you don’t file and pay, interest and penalties will keep adding up. You could even lose your business or go to jail in severe cases.

What to Do if You Have 941 Payroll Tax Problems

If you can solve the problem right now by filling out the form or making a deposit, and the IRS isn’t going to hit you with huge fines and penalties, do it. That’s the most effective way to resolve the problem.

However, if your payroll tax difficulties have grown severe, you should contact an expert payroll tax attorney to represent you before the IRS. An Enrolled Agent has received specialized training and has the relevant expertise and experience to advocate for you at all levels of the IRS bureaucracy.

At Seattle Legal Services, we understand the ebbs and flows of business cash flows because we are small business owners ourselves too. We will fight to save your business and your livelihood from the IRS.

Business 941 Payroll tax cases can be some of the most complicated cases to resolve. You do not want to go it alone if you have payroll tax issues. The IRS takes Payroll Tax Cases very seriously and has its Revenue Officers pursue them aggressively. The Revenue Officers have one goal COLLECT NOW!

When you fail to pay the federal withheld tax to the government, the government will come after you for the money. Once for giving out refunds/credits to employees and again for not collecting the taxes from you, the employer. So, you can see why the government is not sympathetic in these cases.

When this situation arises, the IRS can and usually will look for responsible parties to assess the trust fund recovery penalty against people they deem a “Responsible Party.” The IRS does this so that they can collect against both the business and the person responsible for willfully neglecting to remit the payroll deposit. This means two payment plans so the government can recover its money faster.

To be deemed a responsible party, the IRS will see if a person acted Willfully and if a person had Financial Control over the business. They will consider if an employee/owner had the following responsibilities:

- Determine the financial policy for the business.

- Direct or authorized payments of bills/Creditors?

- Prepare, review, sign, or authorize to transmit payroll tax returns.

- Have knowledge that withheld taxes were not paid?

- Authorize payroll?

- Authorized the assignment of any EFTPS or electronic banking pins?

- Passwords?

- Could other individuals do any of the above?

- Has signature authority on business bank accounts?

Our payroll tax lawyers have extensive experience defending against trust fund recovery assessments and the negative consequences associated with payroll tax problems.

Complex Payroll Tax Problems

If you’re a business owner, then you’re affected by payroll taxes. Occasionally, you may run into a payroll tax problem or two. Both large and small businesses sometimes need representation to help them deal with issues that can arise regarding payroll tax deposits. Tax debt can be particularly harmful to small business owners, so contact a tax attorney today if you need assistance dealing with the IRS. We strive to serve businesses in Seattle, Bellevue, Tacoma, Kirkland, Everett, and all the rest of Washington State.

What Are Payroll Taxes?

Payroll taxes are withheld from employee wages. Business owners withhold these taxes from employee paychecks to pay federal taxes such as Social Security and Medicare.

Usually, employers must withhold these taxes from employee income only. An employer often doesn’t need to withhold funds from what’s paid to an independent contractor, but they do need to issue the contractor a 1099 form.

Employers who fail to withhold the correct amount from their employees will typically be fined by the IRS.

How Do You Calculate Payroll Taxes?

It’s your duty as a business owner to accurately calculate your taxes to avoid paying penalties. An employer must calculate how much money they need to withhold for payroll tax using one of two formulas.

The Percentage Method

The percentage method is the most complex of the two methods used to calculate payroll taxes. It’s best suited to large businesses. First, you have to figure out how much is due for Social Security and Medicare taxes.

A total of 50% of the money used to pay these taxes must come from the business’s revenue. The other 50% must come from the income of your employees.

The Wage Bracket Method

For the Wage Bracket method, IRS Publication 15-A shows you how to calculate payroll tax deposits in the section “Wage Bracket Percentage Method Table.” These tables are checked into the W4 form.

First, calculate the gross pay for your pay period. You do this in columns A and B of the 15-A form. You then subtract the total from the amount stated in column C of the form.

Finally, there’ll be a number in column D of Form 15-A. Look at the sum you have after subtracting the gross pay from the number in column C. Multiply this sum by the number in column D.

Your results should show you how much you need to withhold from each employee’s paycheck for payroll tax.

What Are Some Common Payroll Tax Problems?

Every business makes mistakes from time to time, and mistakes can lead to an IRS audit. Mistakes can also lead to penalties, so ensure you do everything possible to avoid the common payroll tax problems discussed below.

Failure to Pay and Make Payroll Tax Deposits On Time

The IRS issues penalties and fines when your tax isn’t paid on time. You must have your payroll tax paid by the 15th of every month once taxes are withheld from employee income.

Failure to Pay and Withhold Federal Taxes

If a business fails to withhold tax money from employees, then the IRS may issue the business a hefty fine. If a business does withhold tax from employees but deliberately neglects to deposit the tax, then the business owner could face serious consequences such as jail time.

Failure to Issue Forms

Failure to issue the appropriate forms to employees can lead to serious payroll tax problems. If you have an independent contractor from the United States, and you pay them $600 or more in a year, then you must issue them a Form 1099.

Failure to issue a 1099 form is one of the most common tax problems. You may have to pay $75 for every 1099 IRS form you fail to issue.

Inexperienced People Should Not handle Payroll Tax Cases.

Take the first step toward getting your payroll tax problems resolved – contact us today by completing our simple contact form to get started today.

Frequently Asked Questions on Payroll Tax Problems

One of the reasons for the large payroll tax could be the Tax Cuts and Jobs Act, which lowered taxes generally. With individual income taxes now lower for most low- to middle-income Americans, payroll taxes have increased compared to overall income taxes.

The Tax Withholding Estimator on IRS.gov can help most employees by determining whether or not they need to give their employer a new Form W-4. The results from the estimator can be used to fill out the form and properly adjust income tax withholding.

Yes, every employee must pay payroll taxes. This includes federal income tax, Social Security tax, and Medicare tax. Your employer will withhold these taxes from your paycheck and remit them to the appropriate agencies.

A payroll tax lawyer’s job is to help your company resolve payroll tax disputes. This helps you avoid criminal charges and substantial penalties from failing to remit payroll taxes properly. A payroll tax lawyer is an expert at dealing with federal and state agencies. They know payroll tax law inside and out, meaning they can also audit your current business practices to make sure you are abiding by the standards set by the Internal Revenue Service.

If you’re a business owner, it’s important to make sure you don’t run afoul of IRS rules. The IRS takes payroll taxes very seriously and will not hesitate to impose penalties on your business for failing to pay your payroll taxes. Consider a few common scenarios that create payroll tax problems.

One of the most common problems involves independent contractors. If you improperly classify employees with independent contractor status, you likely have no income tax withholding agreement in place. You won’t make the proper payroll tax payments and will build up a significant payroll tax liability.

Another common cause of tax debt is failing to calculate your payroll tax correctly. A business must have a designated responsible person who tracks accounts receivable and payable. If this person makes mistakes when calculating your tax or chooses to pay other debts before tax debt, your business could get into trouble when the IRS does the math and finds you’ve underpaid your taxes.

The IRS, by default, takes a company at its word. However, the IRS routinely compares your tax declarations against their numbers to make sure they match. If they find you have not paid enough in payroll tax, they will first send a written notice to the business owner or responsible person.

This notice will indicate the amount of tax to be paid and may include a fee for late payment. It will also tell you how long you have before further action is taken.

If you ignore this notice, penalties will continue to accrue. You may receive a final warning that your assets, including money held in bank accounts, could be seized to satisfy the debt. If you receive any kind of notice like this, you should immediately talk to a payroll tax attorney about back tax resolution. Otherwise, civil penalties will continue to pile up.

Deliberately ignoring these notices could also lead to more serious problems. It’s always best to respond to them right away.

Generally, criminal charges are rare in payroll tax disputes. For this to happen, there has to be a pattern of willful conduct that violates tax law. For example, if you withhold payroll taxes, tell your staff that you have paid all of their appropriate taxes, and instead pocket the money or use it for other business expenses, this could be seen as an act of fraud.

If your company has received a notice about taxes owed due to a payroll issue, it’s in your best interest to talk to a payroll tax lawyer for back tax resolution. The sooner you act, the safer you will be.

This is when the IRS audits an employee retention credit (ERC) from your 2020 or 2021 employer tax returns. The process is similar to a payroll audit, but it focuses specifically on your business’s eligibility for this COVID-era credit.

If you’re having trouble with payroll taxes, or if the IRS is coming after you for back taxes, then contact Seattle Legal Services, PLLC. Call us at 206-895-7268. We’re happy to help small and large businesses that need representation.